Home Sweet Home

The unthinkable was happening — and Rachel thought of everything. That was her job after all, as a lawyer, to be thorough and prepared. But for this, she was utterly unprepared.

It was mid-February, and Rachel and her husband were in the final stages of closing on their new home in Dickinson, ND. With two boys and a two-week-old daughter, the growing family was ready to move into a home with more space for the kids. They had worked closely with builders to design their new home, and everything was nearing completion.

“These are real people, with real houses, real money, and real families. It’s their life, and it’s real,” she said. “Our team respects that. Every day, we’re all hands on deck. We like to say, ‘things are always figure-out-able.”

“Whether it’s building a house or starting a business, or getting their own herd of cattle,” Tom added. “We’re a middle man to help them achieve their dreams.”

It was certainly a dream come true for Rachel and her family, who are now happily moved and settled into their new home. In fact, the experience made such an impression on Rachel, she decided to move her business and personal accounts over to Choice Bank.

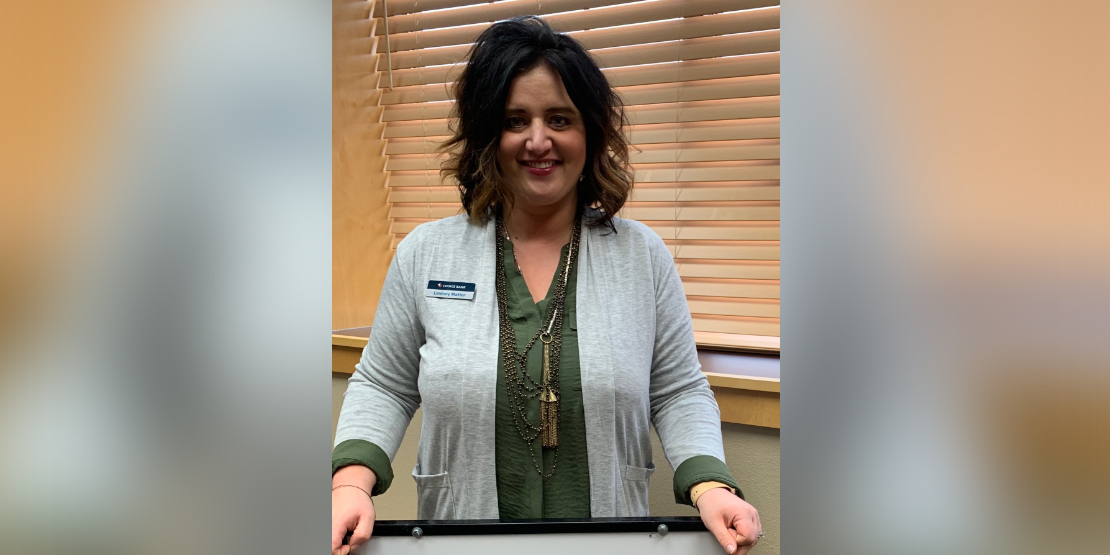

The Choice Bank core values, “Seek and share knowledge” and “Commit to your customers with undivided attention” rang true for Tom and Lindsey in this story. They are values they no longer actively think about; they’re simply woven into the Choice Bank culture that they seem second nature.

“It’s just what we do,” Lindsey said. “This is what sets us apart.”

Our People First values are at the heart of everything we do. Learn more about our passion for putting People First here.