It Takes a Village

Client Services Specialist Josie Henningsen answered the first call that came into the Bismarck North Choice Bank location one morning. Another bank had called to verify a check they’d received from Jeff, a Choice customer and small business owner in Bismarck. The request itself was not all that unusual. However, there was one red flag: the call came from Missouri.

“It looked just like Jeff’s signature, but I just thought, ‘Something doesn’t feel right.”

At Choice Bank, team members follow a strict procedure when asked to verify funds on checks to protect customer information.

“When I saw the check, I noticed that he did have the funds available, and it looked just like Jeff’s signature, but I just thought, ‘Something doesn’t feel right,’” Josie said.

When she got off the phone, Josie called upon Retail Location Manager Joyce Dewald to take a look at the suspicious check. Agreeing that something seemed off, Joyce called Missy Lamp, Client Services Supervisor at the Bismarck South location across town.

“Yup. We’re getting those calls too,” Missy said.

All morning, the phones continued to ring at both Bismarck locations. The calls came from Texas, Ohio, Alaska, Georgia, Oklahoma, California, New York—all asking to verify concerning checks they had received from a man named Jeff in Bismarck, North Dakota.

“Aside from Jeff, another victim was the people who were receiving these fraudulent checks.”

The team sprang into action. An email went out to the entire Bismarck front line staff explaining the situation. Team members made sure to view every check that came through, informing the inquirers that the checks were fraudulent.

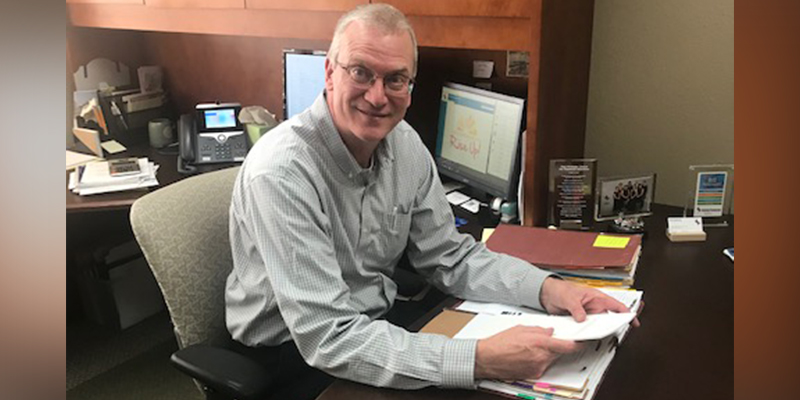

Missy contacted Bill Robinson, who has served as the banker on Jeff’s commercial account for almost 10 years.

“Jeff has been a small business owner in this market for 25 years, and he is very well-known within the community,” Bill said. “At the end of the day, he is the main hardware guy that almost everybody in Bismarck goes to. He’s really a key person in our community, and we are always going to do everything we can to keep customer accounts safe.”

While there is no way to be certain how Jeff’s account was compromised, it is likely that his information was taken directly from a genuine check and sold on the dark web. Bill and the team were able to link the checks back to an internet pop-up that was advertising vinyl skins for cars. Whenever someone clicked on the pop-up, it triggered the delivery of a fraudulent check to that person.

“The scammers would include a letter saying, ‘We overpaid you, please keep $500 and send the rest back to us,’” Missy said. “That’s how the scammers are making money. So, aside from Jeff, the people receiving the fraudulent checks were also victims.”

Small businesses are at risk of losing twice as much because of fraud compared to big businesses.

The calls continued for almost two weeks. Combined, the two banks received at least 30 calls from 25 states, while Jeff received countless more directly to his store. If all of the fraudulent checks would have cleared, the total monetary loss would have been more than $750,000—a substantial loss for anyone, but especially a small business owner said Bismarck Location President Deb Eiseman.

“That’s his cash to buy inventory, pay his bills,” Deb said. “A $100,000 loss, even $50,000, hurts small business.”

In fact, the 2018 Report to the Nations: Global Study on Occupational Fraud and Abuse by the Association of Certified Fraud Examiners (ACFE) cites that small businesses are at risk of losing twice as much because of fraud compared to big businesses with the median loss averaging around $200,000.

Recovery from such a loss for a small business can be a draining process, even fatal. But thanks to the quick thinking and clear communication of the Choice teams in Bismarck, not a single one of the checks cleared.

“For me, this really shows our core value of ‘Commit to our Customers with Undivided Attention,’” Deb said. “They knew right away what steps had to be implemented to protect the customer and protect the bank. Had they not been watching, listening, and following procedure, there could have been some sizable losses.”

The team at Choice did not just prevent this attempt at fraud from harming Jeff’s business but also set him up to be better protected in the future. Just weeks after the first wave of suspicious checks appeared, another wave picked up. Given the extent to which Jeff’s account had been compromised, they decided to close it and open a new account for his business.

Bill worked with Loretta Carlson and the rest of the Cash Management team to set up the account with Positive Pay, a fraud prevention tool that allows business customers to monitor all checks and ACH debits for any potential fraud.

“Had they not been watching, listening, and following procedure, there could have been some sizable losses.”

“Because he was hit with a second wave, we thought it was better to just change accounts. For peace of mind,” Bill said. “There is no guarantee that it won’t happen again, but at least if it does start happening again, we’ll catch it immediately.”

When the new account had been set up, Missy went down to Jeff’s store in person to have the paperwork signed. Rather than frustration that his account had been compromised in the first place, Jeff greeted Missy with overwhelming gratitude.

“When I went down to the store, the comments Jeff and his staff were making about our bank was just wonderful. They were so appreciative,” Missy said. “People have heard about it and have been asking Jeff, ‘Is your business okay? Are you okay?’ And he’s been speaking very highly of Choice and how we have treated them.”

What could have been a million-dollar fraud case became an opportunity to strengthen a relationship with an already loyal customer—all because a group of Choice employees acted quickly, followed protocol, and, most importantly, worked together as a team.

“It wasn’t just one person,” Missy said. “It was everybody”

Avoid the pains and financial loss associated with check fraud. Positive Pay allows you to detect and return fraudulent checks. Learn more here.

Our People First values are at the heart of everything we do. Learn more about our passion for putting People First here.