Home Sweet Home

The unthinkable was happening — and Rachel thought of everything. That was her job after all, as a lawyer, to be thorough and prepared. But for this, she was utterly unprepared.

It was mid-February, and Rachel and her husband were in the final stages of closing on their new home in Dickinson, ND. With two boys and a two-week-old daughter, the growing family was ready to move into a home with more space for the kids. They had worked closely with builders to design their new home, and everything was nearing completion.

The unthinkable was happening — and Rachel thought of everything. That was her job after all, as a lawyer, to be thorough and prepared. But for this, she was utterly unprepared.

One week away from move-in day, they got a call from their bank. Something had changed with the paperwork. It appeared Rachel and her family no longer qualified for the secondary market financing.

Rachel was at a loss. Feeling frantic, she called family friend Tom Fath, Location President for Choice Bank in Dickinson.

“She was deflated, to say the least,” Tom said, recalling that phone call. “They were all packed up and had already moved the majority of their stuff into the garage of their new house.”

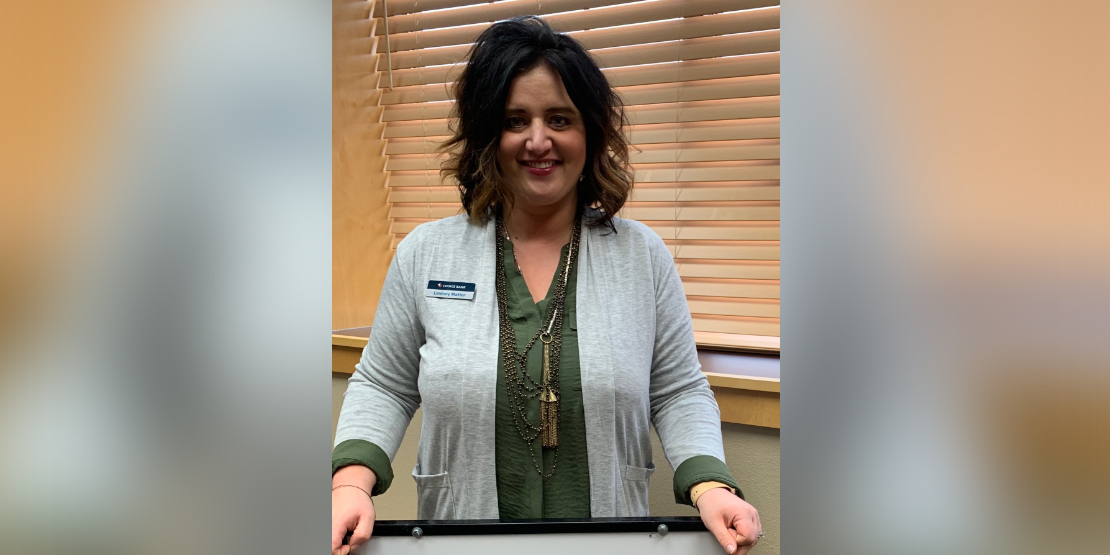

Tom was determined to help out the young family, and he knew who could do the job. He called up Lindsey Matter, Senior Vice President Mortgage Loan Officer at Choice Bank in Bismarck.

“He gave me the backstory, and I asked right away if I could call Rachel,” Lindsey said. Tom introduced the two women, and they got to work.

It wasn’t long before Lindsey understood what had happened. It’s simple, she explained; at the end of 2018, Rachel had changed the name of her law firm. It operated beneath the same trade name, with the same EIN. But because the name had changed, it confused the mortgage lenders at the other bank. Lindsey, however, was able to sort through the problem without a hitch.

“The crucial part was making sure someone understood that. The mortgage world is so black and white, sometimes these little changes seem to create a mess,” she said. “But when we got to the root of it, it was all really simple.”

Lindsey started a new process with Rachel, and the two worked quickly to fill out and file a new application that same day. Within an hour and a half of Rachel calling Tom, they had a full application complete and submitted.

Meanwhile, the stakes were rising for Rachel. Without secondary market financing, Rachel’s builder asked for 20K in earnest money. If this didn’t go through, Rachel and her family would lose their home, be out $20,000, and would be forced to cram into an apartment.

The stakes were rising for Rachel. Without secondary market financing, Rachel’s builder asked for 20K in earnest money.

But Lindsey reassured her as best she could.

“I know you don’t know me,” she told Rachel. “But don’t worry. I’ll get you home.”

Thinking back, Lindsey knew it was not an easy time for Rachel. She didn’t bank with Choice Bank (at the time). She didn’t know Lindsey, or their team.

“She had every reason to believe it would fall apart again. I just kept telling her to trust me,” Lindsey said. “It’s important for me to always do good work and work I can be proud of. I knew we could work it out for them.”

Tom, a trusted friend of Rachel’s, knew in Lindsey’s capable hands that the job would get done.

“I knew we were going to be able to do something for them,” he said. “I knew she was in good hands.”

True to her word, 27 business days later, Rachel’s loan was approved. Everyone breathed a collective sigh of relief.

To celebrate, Lindsey sent a card to Rachel and her family; the cover said, “Man, it feels good to be home.”

Working with Rachel was a reminder to Tom and Lindsey of the very reason they love what they do; it’s making people’s dreams a reality.

“Every day, we’re all hands on deck. We like to say, ‘things are always figure-out-able.”

“These are real people, with real houses, real money, and real families. It’s their life, and it’s real,” she said. “Our team respects that. Every day, we’re all hands on deck. We like to say, ‘things are always figure-out-able.”

“Whether it’s building a house or starting a business, or getting their own herd of cattle,” Tom added. “We’re a middle man to help them achieve their dreams.”

It was certainly a dream come true for Rachel and her family, who are now happily moved and settled into their new home. In fact, the experience made such an impression on Rachel, she decided to move her business and personal accounts over to Choice Bank.

The Choice Bank core values, “Seek and share knowledge” and “Commit to your customers with undivided attention” rang true for Tom and Lindsey in this story. They are values they no longer actively think about; they’re simply woven into the Choice Bank culture that they seem second nature.

“It’s just what we do,” Lindsey said. “This is what sets us apart.”

Our People First values are at the heart of everything we do. Learn more about our passion for putting People First here.